Santa Monica, California

Through harnessing the power of art to bring about a positive change, Lissa Mel's vision continues to evolve. From her groundbreaking work as a vibrational artist to a gallerist showcasing emerging artists, Lissa aspires to make a meaningful impact. She has embraced a resilient mindset that spreads positivity to others in hopes of creating a ripple effect of goodness in the world. Her story serves as a reminder that creativity knows no boundaries and the human spirit is an unstoppable creative force.

Through harnessing the power of art to bring about a positive change, Lissa Mel's vision continues to evolve. From her groundbreaking work as a vibrational artist to a gallerist showcasing emerging artists, Lissa aspires to make a meaningful impact. She has embraced a resilient mindset that spreads positivity to others in hopes of creating a ripple effect of goodness in the world. Her story serves as a reminder that creativity knows no boundaries and the human spirit is an unstoppable creative force.

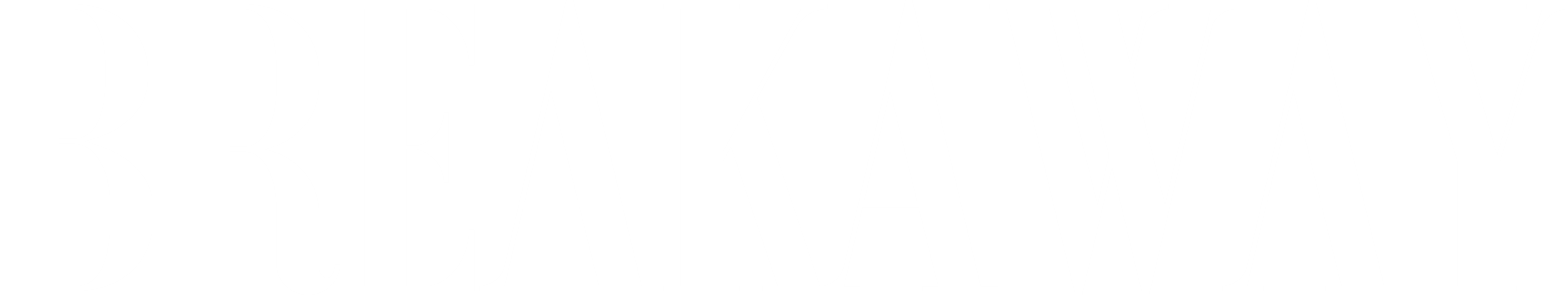

As the foliage changes and takes on new colors, you too can turn over a new leaf and make a fresh start this fall. In today's fast-paced world, finding moments of stillness and introspection can seem daunting. In a society addicted to constant stimulation, Alisa Gracheva advocates for the power of relaxation, meditation and going within. As a renown spiritual & mental health therapist, Alisa has mastered the art of guiding individuals to a peaceful existence by helping them focus their energy and prioritize mindfulness.

Dallas, Texas

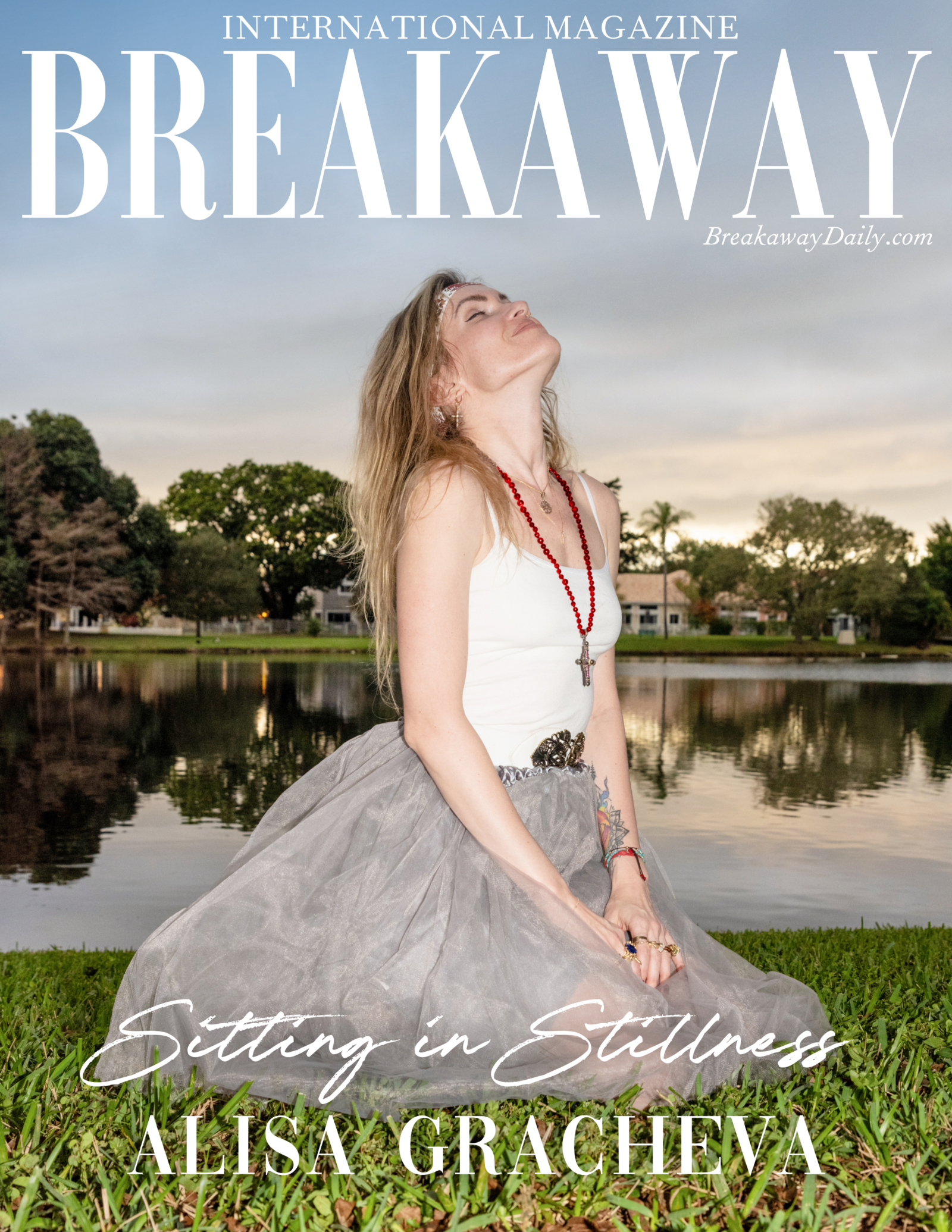

In a world where representation and inclusivity are crucial, beauty industry veteran Carlita Smith stands as a beacon of empowerment. As a cosmetologist and entrepreneur, she has made a significant impact in her industry with her brand Carlita Cosmetics. She is driven to break down barriers in the industry and create a platform of inclusivity for all. As we delve deeper into her journey, challenges and triumphs, we celebrate her remarkable achievements as a Black woman in business.

In a world where representation and inclusivity are crucial, beauty industry veteran Carlita Smith stands as a beacon of empowerment. As a cosmetologist and entrepreneur, she has made a significant impact in her industry with her brand Carlita Cosmetics. She is driven to break down barriers in the industry and create a platform of inclusivity for all. As we delve deeper into her journey, challenges and triumphs, we celebrate her remarkable achievements as a Black woman in business.

Toronto, Ontario

Natalie Telfer aims to be honest and helpful to women as a part of the Cat & Nat duo. Nat and her best friend, Catherine Belknap, created Cat & Nat to discuss truths about motherhood through their popular podcast and videos. Since the beginning, their primary goal has remained unchanged, which is to create an environment of joy and togetherness among women and mothers through laughter. Knowing firsthand the loneliness that motherhood can bring, they made it their mission to unite mothers by first organizing dinner parties and events. Through the success of their events among Toronto mothers Cat & Nat broke into the online world, where they were able to connect with and support moms everywhere. Together they have built a thriving social media empire and a rapidly expanding community of like-minded moms.

Natalie Telfer aims to be honest and helpful to women as a part of the Cat & Nat duo. Nat and her best friend, Catherine Belknap, created Cat & Nat to discuss truths about motherhood through their popular podcast and videos. Since the beginning, their primary goal has remained unchanged, which is to create an environment of joy and togetherness among women and mothers through laughter. Knowing firsthand the loneliness that motherhood can bring, they made it their mission to unite mothers by first organizing dinner parties and events. Through the success of their events among Toronto mothers Cat & Nat broke into the online world, where they were able to connect with and support moms everywhere. Together they have built a thriving social media empire and a rapidly expanding community of like-minded moms.

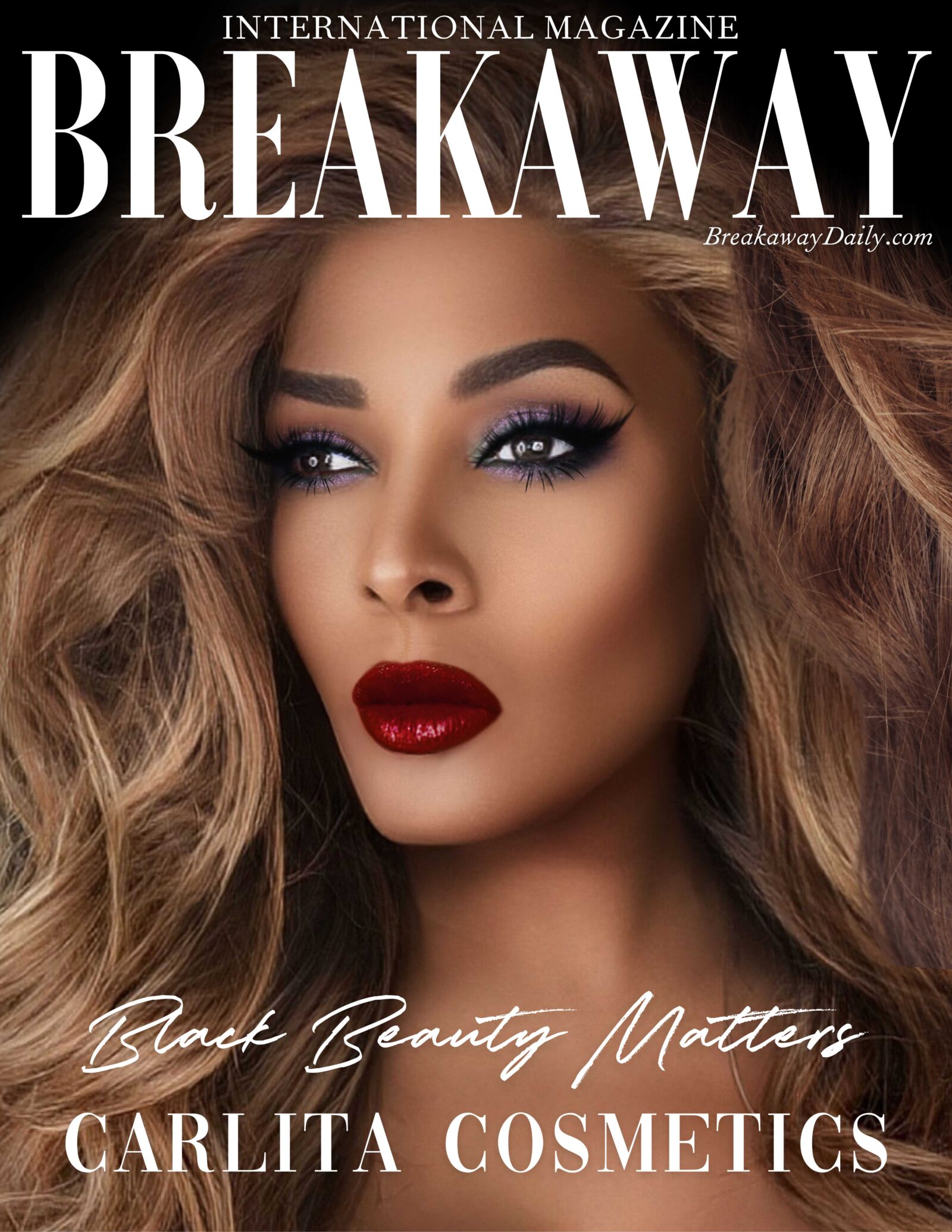

With each project he undertakes JR Michael‘s passion burns brighter, igniting hope and illuminating the path toward a better future. His dedication to raising awareness about the global human trafficking crisis, indigenous rights and other vital issues reflects a deep compassion for humanity. As an independent actor and filmmaker, his work is fueled by passion and a desire to make a difference in the world through every project he takes on. He seeks to bring forth fresh ideas and perspectives, tackling important issues of the human spirit and societal relevance.

Ocoee, Florida

Santia McKoy is using her artistry to show her support of the Haitian revolution and the protection of its people. Her gesture of solidarity has been directed at a cause close to her heart and home that reaches beyond borders. Santia has designed this symbolic homage to her homeland in distress, which speaks of the unity between the everyday men and women who are fighting for their freedom from oppression. "As a Haitian designer who is constantly inspired by my country, I felt compelled to take the initiative to make something powerful out of this horrific situation."

Santia McKoy is using her artistry to show her support of the Haitian revolution and the protection of its people. Her gesture of solidarity has been directed at a cause close to her heart and home that reaches beyond borders. Santia has designed this symbolic homage to her homeland in distress, which speaks of the unity between the everyday men and women who are fighting for their freedom from oppression. "As a Haitian designer who is constantly inspired by my country, I felt compelled to take the initiative to make something powerful out of this horrific situation."

Los Angeles, California

Hayden Rivas is a testament to not let any obstacles stop you from pursuing your aspiration of a career, studies or quest for knowledge. His skillset goes far beyond the art of movement as he seeks to learn as much as possible to provide a valuable voice and presence in the industry. He aims to break down barriers and pave the way for more diverse representation. Hayden's motivation stems from the lack of diversity he saw in the industry growing up.

Hayden Rivas is a testament to not let any obstacles stop you from pursuing your aspiration of a career, studies or quest for knowledge. His skillset goes far beyond the art of movement as he seeks to learn as much as possible to provide a valuable voice and presence in the industry. He aims to break down barriers and pave the way for more diverse representation. Hayden's motivation stems from the lack of diversity he saw in the industry growing up.

Ocoee, Florida

S & M Custom Design is a family owned, high-end custom fashion house. Valentine's Day for designer Santia McKoy is a celebration of love for her family and the eleventh anniversary with her husband Adrian. It is a day they believe is best celebrated with their three daughters, family and close friends. A special kind of love has inspired her new collection; that deep, unconditional love of a mother. Named after her youngest daughter Isabella, The Bella Collection takes inspiration from Isabella's vibrant spirit and carefree attitude. The collection is made up of six incredibly designed dresses that have taken approximately three months to finish from design to completion. It will be released on the 28th of May this year.

S & M Custom Design is a family owned, high-end custom fashion house. Valentine's Day for designer Santia McKoy is a celebration of love for her family and the eleventh anniversary with her husband Adrian. It is a day they believe is best celebrated with their three daughters, family and close friends. A special kind of love has inspired her new collection; that deep, unconditional love of a mother. Named after her youngest daughter Isabella, The Bella Collection takes inspiration from Isabella's vibrant spirit and carefree attitude. The collection is made up of six incredibly designed dresses that have taken approximately three months to finish from design to completion. It will be released on the 28th of May this year.

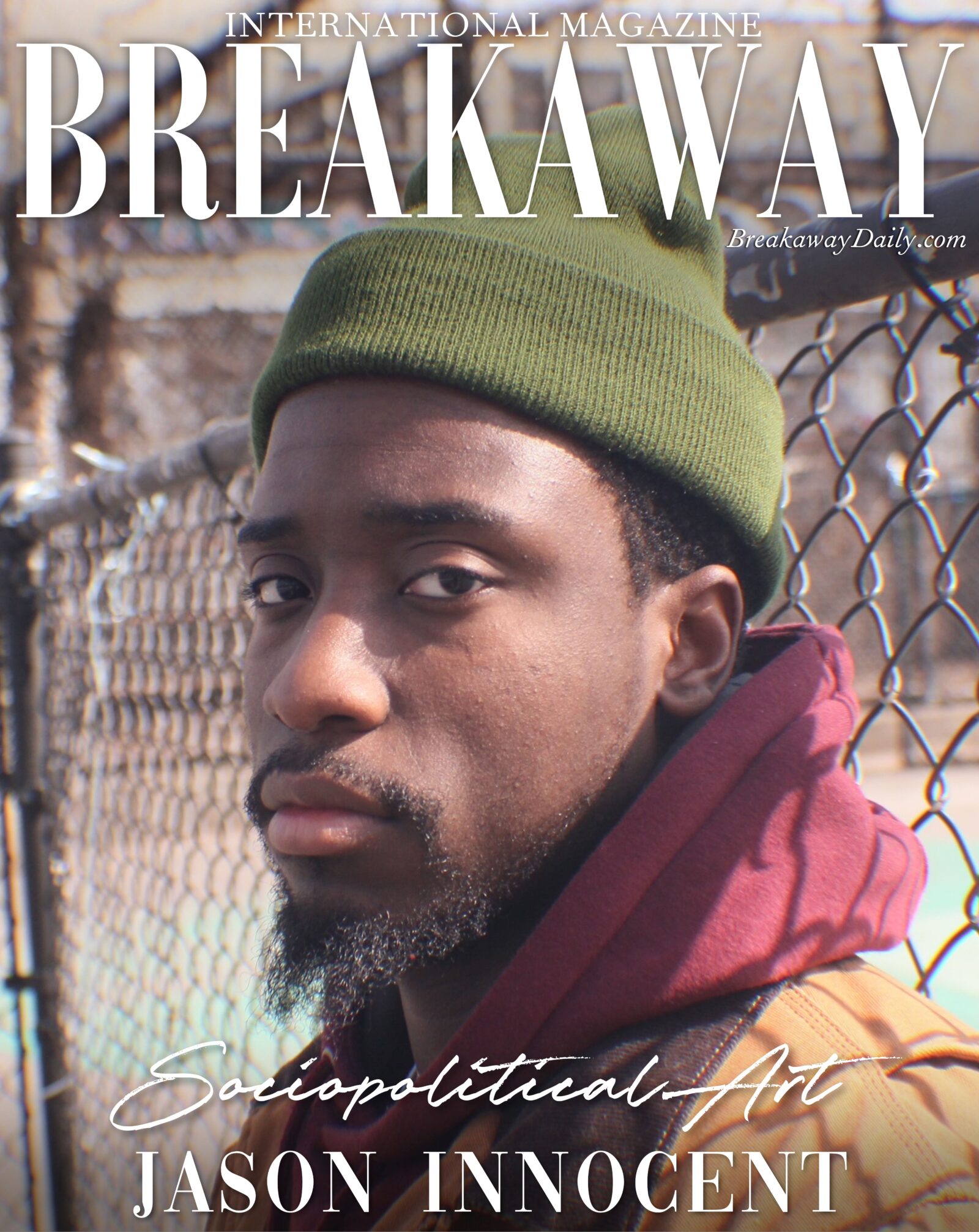

Brooklyn, New York

Jason Innocent is a conceptual artist who has successfully used various mediums to evoke emotion and inspire debate. His ability to address challenging issues through his personal lens gives his work a raw honesty. Jason brings freedom to his art in the creative process representing subject matter that evokes a sense of innocence through his use of two-dimensional, stick-like figures, flat-planed narrative resembling a child’s take on visualizing the world. This aesthetic is cleverly juxtaposed with the mature content of his visual imagery. Jason's work is designed to spark a conversation and challenge social constructs.

Jason Innocent is a conceptual artist who has successfully used various mediums to evoke emotion and inspire debate. His ability to address challenging issues through his personal lens gives his work a raw honesty. Jason brings freedom to his art in the creative process representing subject matter that evokes a sense of innocence through his use of two-dimensional, stick-like figures, flat-planed narrative resembling a child’s take on visualizing the world. This aesthetic is cleverly juxtaposed with the mature content of his visual imagery. Jason's work is designed to spark a conversation and challenge social constructs.

Toronto, Ontaria

Olga Korsak is a Canadian actress, former Olympic figure skater and singer/songwriter. Olga co-wrote, produced and starred in the award-winning horror drama Unmasking, a film to support mental health awareness. She has also appeared in the Amazon original series American Gods. Her most poignant role is in Junga Song's The Petrichor where art imitates life through her performance as a retired figure skater who decides to pursue her dreams again. Written, directed and produced by women, The Petrichor is not just another movie about overcoming adversity. It successfully encapsulates the raw pain and self-determination required to move from a place of weakness to one of strength. It is a poignant reminder that dreams can be brought to life at any age and obstacles can be conquered through inner strength.

Olga Korsak is a Canadian actress, former Olympic figure skater and singer/songwriter. Olga co-wrote, produced and starred in the award-winning horror drama Unmasking, a film to support mental health awareness. She has also appeared in the Amazon original series American Gods. Her most poignant role is in Junga Song's The Petrichor where art imitates life through her performance as a retired figure skater who decides to pursue her dreams again. Written, directed and produced by women, The Petrichor is not just another movie about overcoming adversity. It successfully encapsulates the raw pain and self-determination required to move from a place of weakness to one of strength. It is a poignant reminder that dreams can be brought to life at any age and obstacles can be conquered through inner strength.

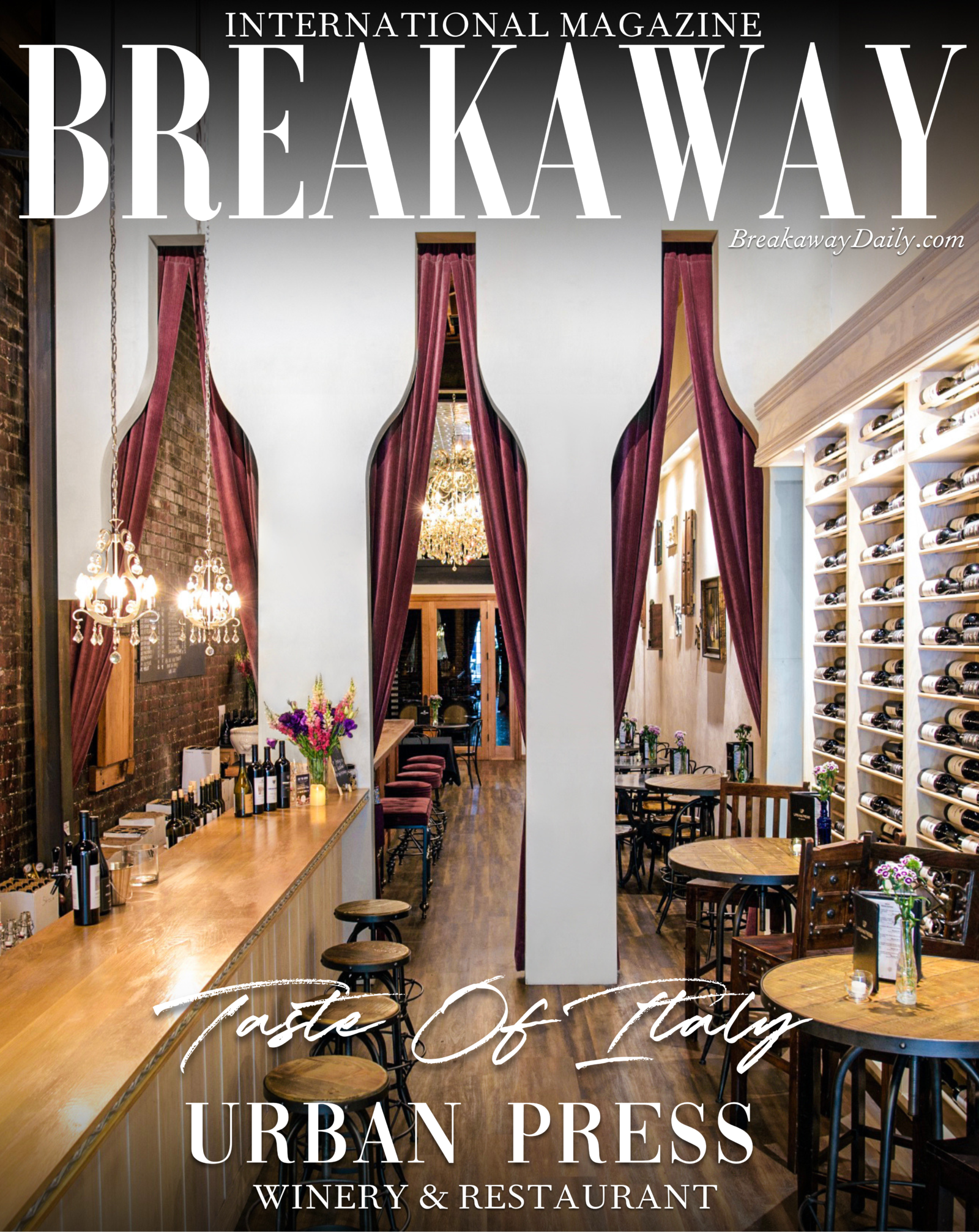

Burbank, California

There is a hidden gem glistening in downtown Burbank. Located in the heart of the media capital of the world is a discovered treasure. Urban Press Winery & Restaurant (UPWR) has the distinction of being the only Los Angeles area winery and fine dining establishment that crafts its own wine from Sonoma. Once you step inside, you will feel as if you have been transported to a bustling trendy spot in Italy. It is a welcome respite from the buzz of Burbank to enjoy Sonoma wine and Italian gourmet in a friendly setting.

There is a hidden gem glistening in downtown Burbank. Located in the heart of the media capital of the world is a discovered treasure. Urban Press Winery & Restaurant (UPWR) has the distinction of being the only Los Angeles area winery and fine dining establishment that crafts its own wine from Sonoma. Once you step inside, you will feel as if you have been transported to a bustling trendy spot in Italy. It is a welcome respite from the buzz of Burbank to enjoy Sonoma wine and Italian gourmet in a friendly setting.